Invest in the energy transition with CVE

Investing in the CVE Group means supporting a manufacturer that has been committed to the energy transition since it was founded in 2009.

Since 2011, we have been involving private investors in our financing model, enabling them to take part in this transition, particularly in the deployment of renewable energies.

By choosing CVE, investors are helping to reduce greenhouse gas emissions, create green jobs and promote responsible management of energy resources. It’s an investment that’s both profitable and virtuous, contributing to a more sustainable future.

Investing in unlisted securities involves the risk of total or partial loss, as well as the risk of illiquidity. Potential investors are advised to consult their financial or tax advisor for further information.

Why invest in renewable energies?

Opt for responsible savings by becoming a player in the energy transition

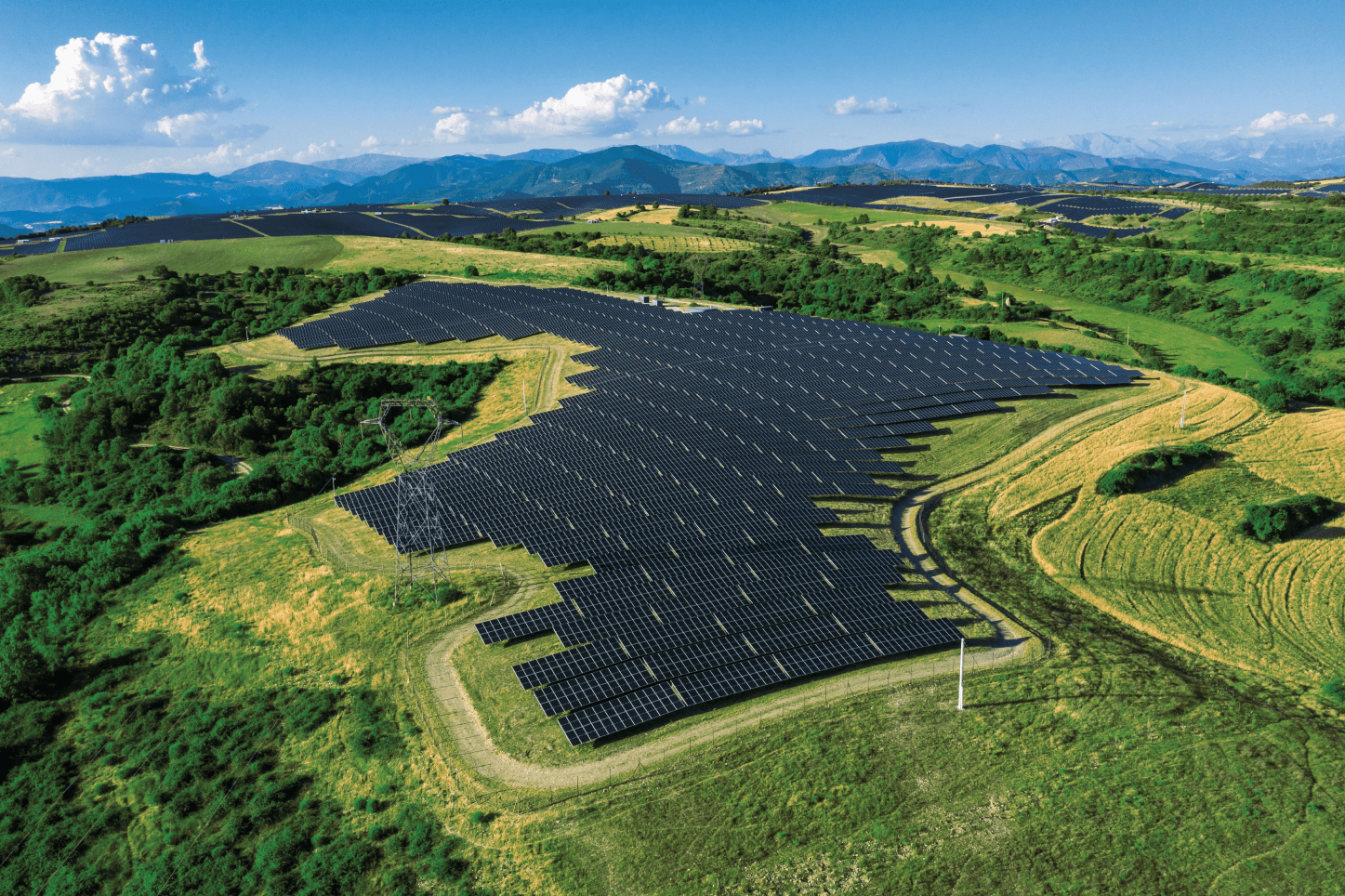

Investing in renewable energies is a concrete step in the fight against global warming. Renewable energies can considerably reduce greenhouse gas emissions.

Investing in renewable energies also means contributing to employment. According to a study by the French Ministry of the Environment and ADEME, continued investment in renewable energies could create more than 900,000 jobs by 2050.

Finally, investing in renewable energies means strengthening local energy sovereignty. Renewable energies enable the deployment of local production capacity.

Our solutions also meet a growing need to give meaning to one’s investment. Through our financial products, private investors participate in financing the energy transition. We can therefore speak of “responsible” or “impact” investment.

A growing company in a buoyant market

The renewable energies market is booming, spurred on by the Paris Agreements to limit global warming.

Since 2016, investment in clean energy has outstripped that in fossil fuels. CVE is actively involved in this crucial energy transition.

Initiatives such as the Green Pact in Europe and the Inflation Reduction Act in the United States, with investments of 300 billion euros and 369 billion dollars, aim to reduce greenhouse gas emissions and strengthen energy sovereignty.

Demand for green energy is growing rapidly. According to the International Energy Agency (IEA), production capacity could more than double by 2050, with significant growth in solar and biomethane.

Since its creation in 2009, CVE has posted average sales growth of 45%, supported by ongoing investment in new projects. More and more private companies, local authorities and farmers are placing their trust in CVE.

Certified B Corp, CVE is committed to sustainable development, fighting climate change and aligning its actions with the preservation of biodiversity, regional development and the promotion of an equitable society.

In short, investing in the renewable energies sector means seizing the real opportunity of a dynamic and promising market, while actively contributing to environmental protection.

Diversifying and responsible investment solutions

The CVE Group offers diversified and varied investment solutions, in the form of securities (shares or bonds) issued by the parent company or its subsidiaries, and whose acquisition is aimed at financing the Group’s global needs or projects directly.

These securities have maturities ranging from 2 to 9 years and offer yields of 7 to 9% per annum.

It’s an unlisted investment in the real economy, based on tangible assets and uncorrelated with the financial markets. This makes it an excellent way for investors to diversify their assets.

Investing in unlisted securities involves the risk of total or partial loss, as well as the risk of illiquidity. Potential investors are advised to consult their financial or tax advisor for further information.

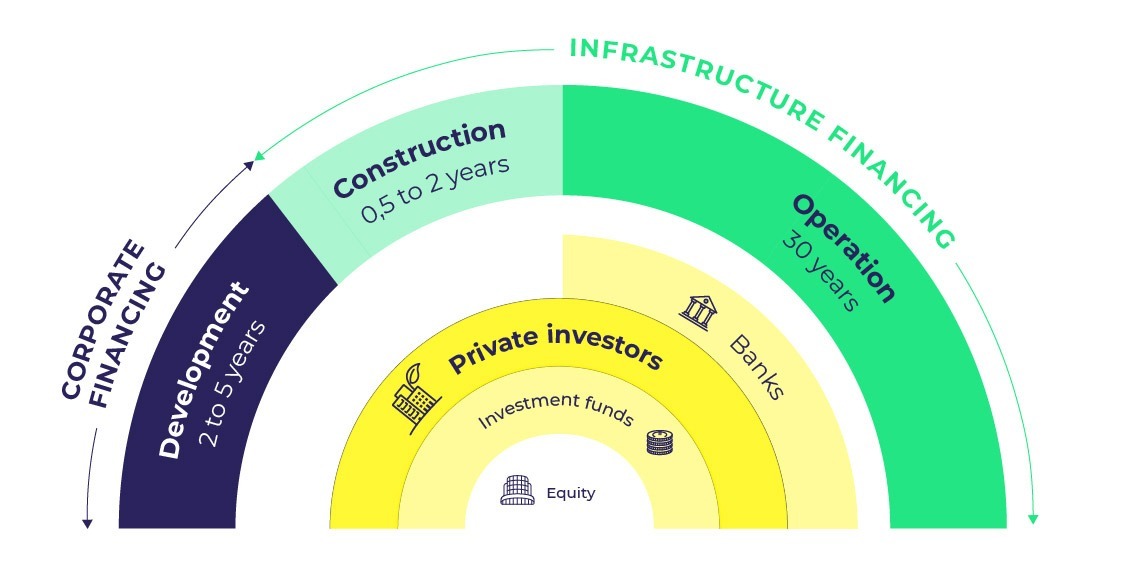

Private investment at the heart of our financing model

Although banks finance the vast majority of our infrastructure investments (sometimes in excess of 80%) private investors have been at the heart of our financing model since the creation of CVE.

As part of the financing of its activities, the CVE Group has acquired considerable expertise in private fundraising, enabling individuals and companies to invest via their Wealth Management Advisor – Financial Investment Advisor or through crowdfunding platforms.

Private investment at CVE in figures

22 300

investors

119

collections

€529 M

collected

€215 M

reimbursed

€314 M

under management

€65 M

Interest and capital gains paid

How to invest ?

With the support of a Wealth Management Advisor – Financial Investment Advisor

To invest in CVE’s investment products, enlist the support of a Wealth Management Advisor – Financial Investment Advisor.

Wealth Management Advisor – Financial Investment Advisor provide their private investor clients with personalized recommendations for investment solutions in the form of unlisted shares or bonds issued by CVE Group companies.

Through our crowdfunding campaigns

Participate in the energy transition by investing in our projects through our crowdfunding campaigns. Find out more about our current and past crowdfunding campaigns on the page dedicated to equity financing.

More

A team of private finance experts

The team in charge of financing the Group’s activities through private investors has more than 10 dedicated staff members, divided between the front office (relations with Wealth Management Advisor – Financial Investment Advisor partners and investors), the middle and back office (administrative follow-up and investor management) and specialists in regulatory compliance. This team is constantly expanding to provide lasting solutions for the Group, ensuring sustainable and responsible growth.

Since CVE was founded, the fundraising team has raised a total of over €500 million, with over €200 million of capital already repaid and over €60 million of interest and/or capital gains paid out, demonstrating the value generated by this investment.

Do you have a question or a project?

Our experts can help you make your project a reality, or simply study your needs and expectations and answer your questions.

Send us your message and we’ll get back to you as soon as possible.