Our integrated report

Our strategic model is based on the production and direct sale of local renewable energies.

ICG, a global alternative asset manager, has invested €200 million in equity and quasi-equity in CVE to support the group’s long-term growth. Our shared governance is based on alignment around the strategic vision and CVE’s purpose.

Putting people and the planet at the heart of tomorrow’s energy

We are collectively committed to an entrepreneurial project that creates economic, environmental and social wealth, where meeting our customers’ energy needs does not compromise the future of the planet or its inhabitants. Our integrated report highlights the deployment of our strategy, our performance and our positive, measurable impact on the environment and society, as close as possible to local needs.

Our strategic levers

Innovation & marketing

From idea to customer, we have defined a process designed to anticipate and accelerate bringing new solutions to market.

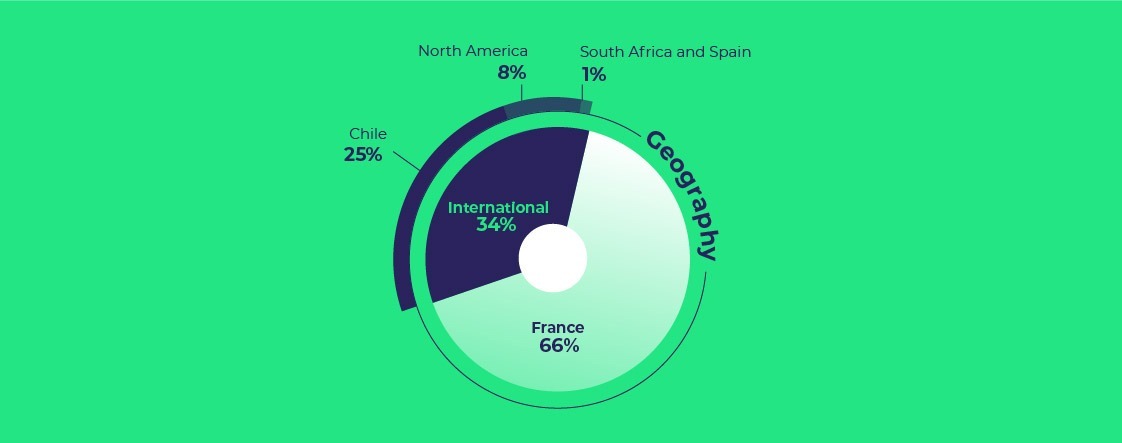

International

Our multi-countries presence in markets aligned with our strategic vision enriches our energy valorization expertise while diversifying our revenues.

Human capital

People are at the heart of our corporate project, which is based on a balance between commitment, individual and collective fulfilment, and the pursuit of excellence.

Impact

As a mission-driven company, our decisions are made considering their environmental, human and social impact in the broadest sense: whether concerning CVE, its stakeholders, or society. Impact assessment of our activities is a veritable compass for the Group’s direction.

Being close to customers

Our multi-energies approach is a strong differentiator. We support our customers in their transition to decarbonization, adapting our offerings to the energy needs of companies, municipalities and the agricultural world.

Our performance

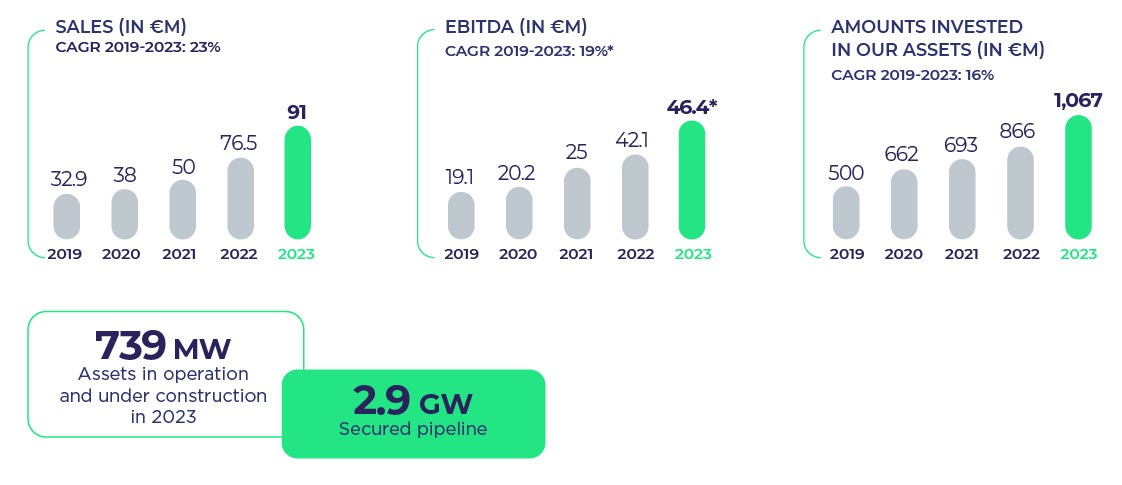

With a secured pipeline that has more than doubled to 2.9 GW and sales up to 19% at the end of 2023 compared to the end of 2022, CVE is one of France’s leading independent renewable energies producers.

In 2023, CVE has once again demonstrated its financial and extra-financial performance, the solidity of its business model and its ability to invest in major new projects.

We expect to have 1.3 GW of assets in operation or under construction by the end of 2025.

Financial and operating performance

*Excluding the amount associated with the Tax Equity Partner (€18.9m in 2023).

Extra-financial performance

2025 targets

Do you have a question or a project?

Our experts can help you make your project a reality, or simply study your needs and expectations and answer your questions.

Send us your message and we’ll get back to you as soon as possible.